How do casino profits and gambling tax work in New Zealand? Do you as a private person have to pay any tax for your online casino winnings?

The short answer is that casino winnings in New Zealand are tax free.

In other words, you as a private person do not have to pay tax on your profits or even report them to the tax authorities.

Do I have to pay tax on my casino winnings?

No, if you live in New Zealand and have won money at either local or online casinos, you do not need to report and tax these winnings.

Winnings from games of chance are considered a hobby activity in New Zealand and are therefore not taxable.

Do I have to pay tax on my winnings if I play with Crypto currencies?

Gambling with cryptocurrencies is a fairly new technology that is not yet regulated by individual countries.

It also means that casino winnings in cryptocurrency fall under the same rules as other casino games.

No tax needs to be paid when you win at an online casino that pays out in cryptocurrencies.

Are all games of chance tax-free?

Yes, your winnings are tax-free regardless of whether you have won on slots, poker, bingo or lotto.

Are there exceptions for gambling tax?

There is. The exception is that you make a living from games of chance, for example good poker players can earn well from their game. This can be counted as income and should be reported to the tax authorities.

Lottery winnings must also be reported if you regularly win. Here Workandincome explains this!

Where can I find information about income tax in New Zealand?

The Income Tax Act 2007 is the very latest document from the New Zealand government where the taxation law is reviewed. You will find it here!

Are casino winnings tax-free in all countries?

In Latvia, for example, you pay 25%, in Slovenia 50% for winnings over $4000, 29% on all games of chance in Nigeria.

In these countries, you are personally responsible for reporting your casino winnings and thus paying tax on them.

In other words, we in New Zealand are very lucky when it comes to casino games as we get to keep 100% of our winnings.

Do casinos pay any gambling tax?

The operators must of course pay tax! However, the operators also do not have to pay tax in all the countries they operate in, but only in the countries that have introduced their own license system and thus also taxation.

However, New Zealand has not had its gambling laws updated since 2003 and thus has no tax income from offshore casinos.

Despite that, it is still tax-free for players from New Zealand to win at these casinos.

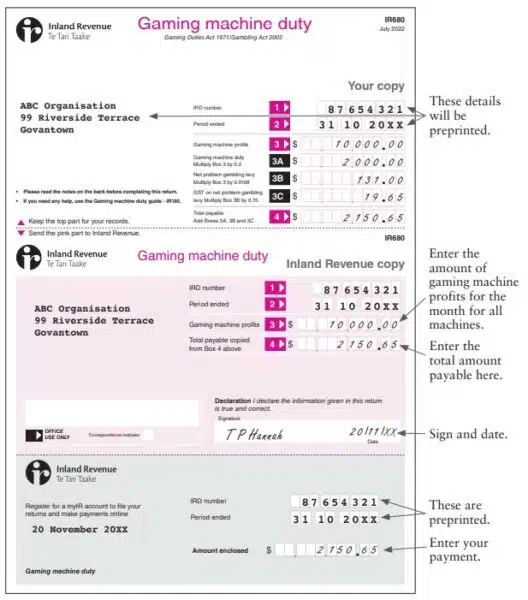

The local actors must pay tax in New Zealand. Below you see a table with the taxes a local casino operator must pay.

| Tax | How much? |

|---|---|

| Casino duty | 4 per cent of the casino wins |

| Gaming machine duty | 20 per cent of gaming machine profits |

| Problem gambling levy | 0.56% off casino wins |

| Lottery | 5.5 percent of the nominal value |

| Totalisator duty | 0% from year 2021 |

However, it is important to know that how much tax the operators pay each year changes depending on how the business has been doing.

What is the gambling act 2003

This is New Zealand’s law for conducting casino operations online and on land. Casinos need to follow this in order to legally conduct their casino operations. Read more about the Gambling Act 2003 here.

Sources:

- https://www.ird.govt.nz/-/media/project/ir/home/documents/forms-and-guides/ir100—ir199/ir180/ir180-2022.pdf?modified=20220725221826&modified=20220725221826

- https://austgamingcouncil.org.au/sites/default/files/2021-10/AGC%20Guide_6_NZ%20Taxation%202018-19.pdf

- https://www.legislation.govt.nz/act/public/2007/0097/latest/contents.html